Blog Post

Why You Should Hire a Professional For Your Expat Tax Needs

- By Elizabeth Hammond

- •

- 08 Oct, 2021

- •

Professionals Have All the Benefits to Offer

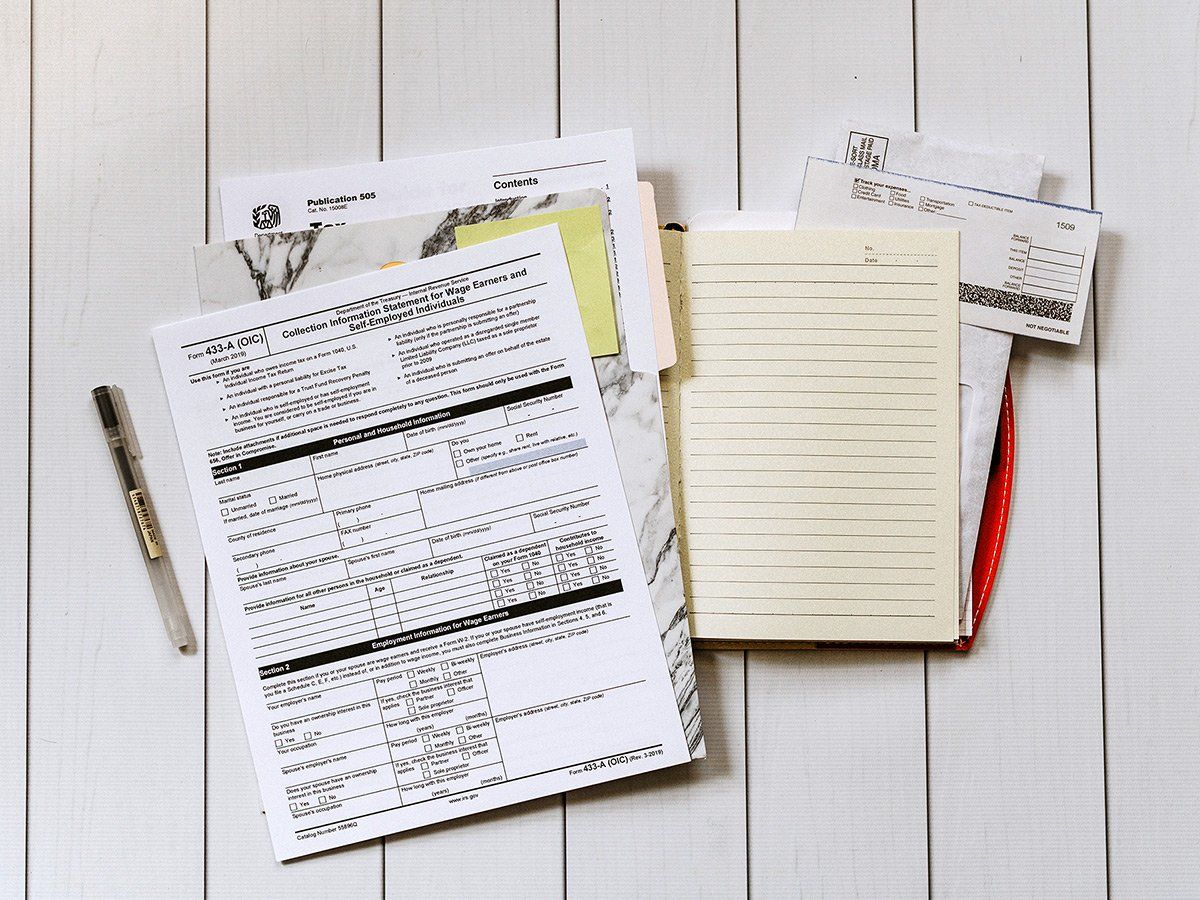

As a UK or Australian expatriate visiting the US, completing your tax income tasks may save you more compared to if you hired a professional to do it. But hile it’s cost-saving to do it personally, there are many benefits to hiring Income Taxes Corp’s expat tax professionals. Read on to learn more!

Save Time

Note that some income tax returns are complex. For example, a small business owner itemizing his deductions has to fill several forms, including the IRS 1040, Schedule SE, and many more. Each form demands various information regarding the taxpayer’s records, like the amounts found in INTs.

A complicated tax system can be challenging to navigate and increases the chances of making errors. Getting a professional for your expat tax services can ease the burden.

Reduce Errors

Tax bodies keep a list of the errors committed when filing tax returns. Top of the list is computational errors made when calculating the taxable incomes, entering payments in the incorrect line, and other simple arithmetic errors.

A small error in your tax return delays any refunds you’re expecting. Making an error also causes a tax liability that attracts interest and fines starting on the day you file.

Therefore, while tax professionals are not perfect, you reduce the chances of error when you work with a professional tax service.

A small error in your tax return delays any refunds you’re expecting. Making an error also causes a tax liability that attracts interest and fines starting on the day you file.

Therefore, while tax professionals are not perfect, you reduce the chances of error when you work with a professional tax service.

Professional Tax Advice

Usually, tax rules are complicated. For example, before using any deduction or credit, you have to be qualified. Our expat tax services can help you determine the deductions and credits you are eligible for. We also give tax advice on non-clear tax issues.

For example, an expat may be able to use a tuition deduction and an education credit, but they can only use one. A professional can advise you on your decision to either take the deduction or the credit.

For example, an expat may be able to use a tuition deduction and an education credit, but they can only use one. A professional can advise you on your decision to either take the deduction or the credit.

Avoid Adverse Consequences

Signing at the end of the tax return means verifying that the information is true and accurate to the best of your knowledge. If there is an audit and errors are found, you could face dire legal consequences.

Using a tax professional adds an extra guard to potential liability. However, you must be cautious and go through the tax return by yourself to confirm the accuracy of the numbers because a tax professional can also make mistakes.

Using a tax professional adds an extra guard to potential liability. However, you must be cautious and go through the tax return by yourself to confirm the accuracy of the numbers because a tax professional can also make mistakes.

Tax returns are a sensitive issue and can sometimes be a challenge, especially for expatriates. That’s why you need professional expat tax services for tax advice and any assistance needed for your unique expat situation. Request consultation with an expert at Income Taxes Corp to eliminate any confusion and hassle of the process, so you are back to your life in the UK or Australia as soon as possible.

Share

Tweet

Share

Mail

Get A Free Quote Fast!!!

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

Please try again later

What We Do

Accutax offers straight forward pricing, a simple process and an expert team of CPAs who have extensive experience in the field of expat tax preparation. We provide accurate, efficient expat tax services for US Citizens living abroad, all at flat fees

Contact info

Accutax Business Center

25 N Broadway

Yonkers, NY 10701

Phone: (914) 613-9222

Fax: (914) 613-9221