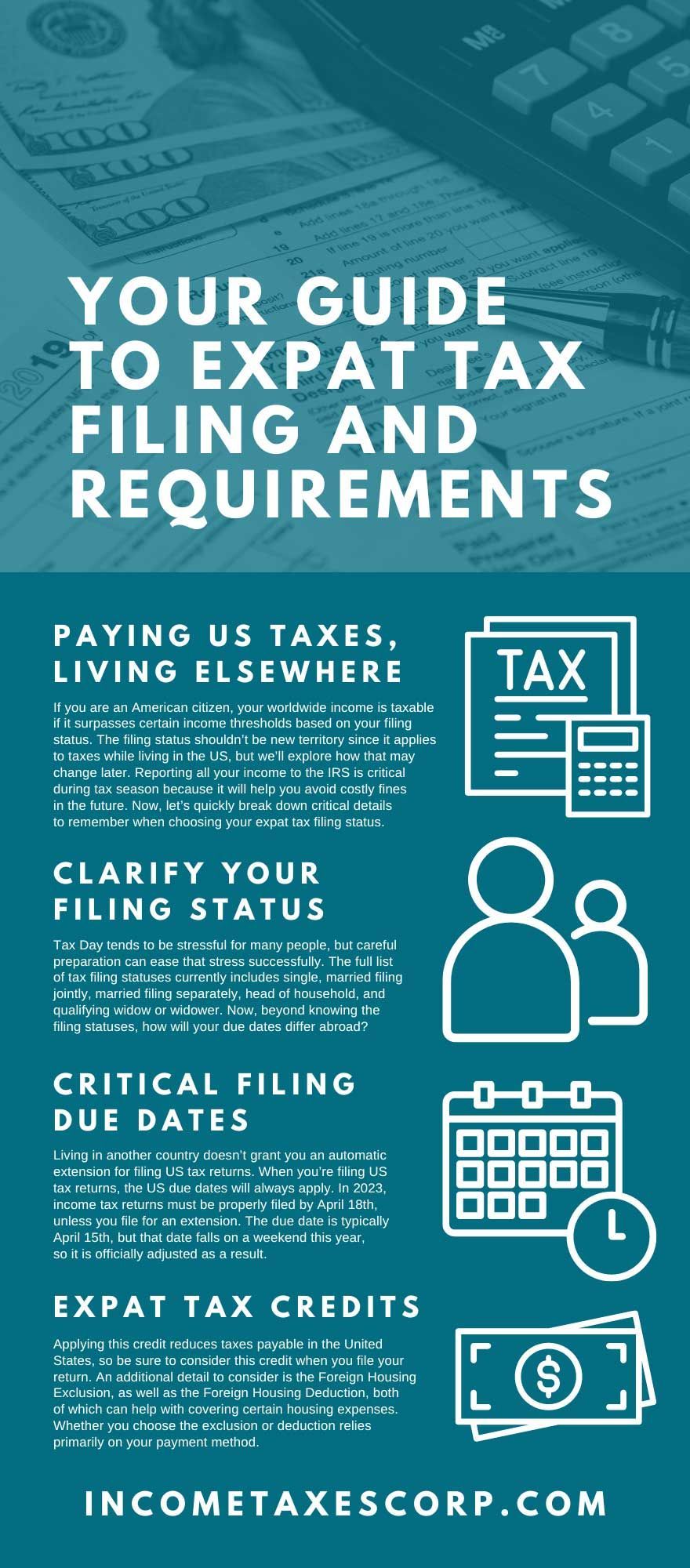

Your Guide to Expat Tax Filing and Requirements

Becoming an expatriate requires planning on many levels, from bringing belongings to finding your new home. Unfortunately, some of the most critical details to remember are also easy to overlook, such as tax information. Your taxes may be the last thing on your mind when moving abroad, but they shouldn’t be. It isn’t as easy as moving to a new country and simply following their tax requirements.

You will have to do that, too, but there’s more to prepare for when moving abroad. To avoid any confusion from clouding your Tax Day experience, continue below to find your guide to expat tax filing and requirements. We’re ready to help you make your taxes easier, so you don’t have to dread filing when the time arrives every year.

Paying US Taxes, Living Elsewhere

Thinking about paying taxes in the country you’re now living in doesn’t start when you move; you have to plan ahead of time, especially for the first year. Right now, you may think that moving outside of the US means you’re moving away from tax filing requirements. It’s understandable to assume that you don’t have to pay US taxes while living in another country, but it’s a bit more complicated than that. US citizens are not only taxed on their US income.

If you are an American citizen, your worldwide income is taxable if it surpasses certain income thresholds based on your filing status. The filing status shouldn’t be new territory since it applies to taxes while living in the US, but we’ll explore how that may change later. Reporting all your income to the IRS is critical during tax season because it will help you avoid costly fines in the future. Now, let’s quickly break down critical details to remember when choosing your expat tax filing status.

Clarify Your Filing Status

Do you know your tax filing status? If you’ve filed in the past, then you should know the answer to that question. In many cases, your US tax filing status still applies when you’re moving to another country. So, consider how your tax filing status may change before your first Tax Day abroad. For instance, are you moving to another country as a new widow? Are you moving with someone you recently married and haven’t determined whether to file separately or jointly?

Don’t overlook these tax-related details when you’re moving to a new country—remembering this will ensure Tax Day is a bit less confusing when it arrives. Tax Day tends to be stressful for many people, but careful preparation can ease that stress successfully. The full list of tax filing statuses currently includes single, married filing jointly, married filing separately, head of household, and qualifying widow or widower. Now, beyond knowing the filing statuses, how will your due dates differ abroad?

Critical Filing Due Dates

Living in another country doesn’t grant you an automatic extension for filing US tax returns. When you’re filing US tax returns, the US due dates will always apply. In 2023, income tax returns must be properly filed by April 18 th , unless you file for an extension. The due date is typically April 15 th , but that date falls on a weekend this year, so it is officially adjusted as a result. Always double-check what day of the week April 15 th falls on before Tax Day to remember the specific due date for that year. US tax return due dates can be easily extended upon request; the due date for tax returns following an extension is October 15 th .

It’s essential to remember these dates for your US taxes, but don’t forget that you’re not only dealing with the United States now. You also have to follow tax requirements for your local area. For example, American expats living in the UK must file their tax returns before October 31 st . However, e-filing is a bit different. If you’re e-filing your UK tax return, then it must be properly submitted by January 31 st of the year following the tax year you’re filing for.

Expat Tax Credits

Although you may be living in another country, you can still experience certain tax credits. For instance, the IRS currently offers the Foreign Tax Credit, which applies to foreign taxes you accrue. This can apply to either a foreign country or a US possession.

Applying this credit reduces taxes payable in the United States, so be sure to consider this credit when you file your return. An additional detail to consider is the Foreign Housing Exclusion, as well as the Foreign Housing Deduction, both of which can help with covering certain housing expenses. Whether you choose the exclusion or deduction relies primarily on your payment method.

As the IRS clarifies online , the Foreign Housing Exclusion applies to costs that you pay for with employer-provided amounts. On the other hand, the Foreign Housing Deduction applies to amounts you pay using self-employment earnings. Seemingly small details can change how you file for your tax return every year. As you can see, even the expat credit topic alone can get quite complex. Luckily, as you’ll learn below, you can partner with experts who will simplify the whole process for you every year.

Working With Tax Preparation Services

Now that you have this guide to expat tax filing and requirements, you can go into your first Tax Day abroad with more peace of mind. Moreover, you can navigate taxes with more clarity, despite your new move potentially changing many details.

However, certain details for how you file are ultimately determined by your specific situation, so it helps to have an expert who can work with you specifically. At Accutax Business Center, we offer American expat tax services that aim to simplify your filing while saving you money and following necessary tax laws.

Working with professionals who specialize in expat taxes specifically is important because you need someone to help you avoid double taxation and other mistakes that can occur during expat tax filings. If you’re an American citizen currently or about to live abroad, start preparing for the upcoming tax season today so you won’t be caught off-guard by all the upcoming changes.